It has been an extremely promising week for the cryptocurrency space with not just Bitcoin reaching an all time high, but also Ethereum, which did so by crossing an important psychological milestone of $2,000.

While Bitcoin has again rallied hard, crossing over its own psychological mark of $50,000 — it has also not shown much signs of slowing down as it moved close to $60,000.

There is also a new No.3 in the market cap rankings as Binance’s utility token, BNB, has also been on a tear away and has become the third largest coin by market cap thanks to its price increase to $349, tripling its value in a week.

A former No.3 in market cap terms, XRP, is also seeing its own rally after being badly dumped at the news that the SEC would be investigating the coin as a security, and turning that investigation against the company. Ahead of the trial’s begin date, there is optimism, and that is reflected in the price spike.

The crypto boom is not being reflected in the traditional markets, but can this rally in the digital space continue this week and into the coming months. Let’s find out more in this week’s market research report.

Traditional Markets Pale In Comparison

Looking away from the crypto space however, there are less promising scenes. Stocks have been trading in a rather muted fashion last week, with worse than expected jobless data as well as rising bond yields sending stocks lower mid-week.

However, dips were bought as the market is confident about the $1.9 trillion stimulus bill vote at month end. Further to the $1.9 trillion proposed by President Biden, Democrats are mulling an additional $3 trillion in a jobs and infrastructure program which boosted sentiment. The Dow Jones index barely moved over the week, while Nasdaq and S&P fell by a mere 0.2%.

The USD has retreated slightly after a surge in bond yields earlier in the week briefly sent it higher. DXY is back down to around 90.3, with the main beneficiaries (other than cryptocurrencies), EURUSD and GBPUSD which are higher. GBPUSD has broken $1.40 while EURUSD reclaimed $1.210. You can expect a strong GBPUSD going forward as on the weekly chart, there is no resistance until $1.4350 levels which was the high in 2018.

Surprisingly, despite USD weakening, Gold and Silver posted losses last week, with Gold now testing $1770 level support again. They however have opened this week slightly to the upside, with Gold bouncing off the $1,770 support.

Crude Oil has slipped back below $60 after a brief visit above as output in Texas is coming back online after the “deep freeze” storm paralyzed production. Moreover, Saudi Arabia is likely to return to higher output levels come Spring, which has sent oil lower in anticipation of more supply to start coming in. But on the back of a further weakening of the USD in anticipation of more stimulus, oil opened the week up 1% but still below $60.

Traditional markets are more or less in a holding pattern waiting for the result of the stimulus vote at month of the month, with nothing much worthy of particular attention.

BTC Smashes $58,000, Altcoins Season Extends For Binance-Related Tokens

The Crypto market however, was rife with action, with BTC finally breaking past the $50,000 mark and headed for higher. However, most of the excitement was on altcoins during the week.

Of particular note are Binance-related tokens. Binance’s token, BNB, tripled within the week to a high of $349 from $120 and inched out USDT to become the 3rd largest capitalisation token.

BNB is the native token that powers the Binance Smart Chain (BSC). BSC has recently emerged as the most probable ETH challenger for DeFi projects because of its higher speed transaction and most importantly, far lower fees than ETH.

Projects built on ETH have been plagued by the high transaction fees which makes it unprofitable to do yield-farming for most investors, unless one is a high-value investor putting in lots of money.

Hence, DeFi projects built on BSC like Venus and PancakeSwap, saw large TVL inflows and as a result, their respective tokens, XVS and CAKE, rallied very strongly following BNB, also tripling in a week. Pancakeswap has overtaken Uniswap in daily trading volume and Venus has beaten Sushiswap in TVL; great feats for BSC having been in the market for barely 5 months.

Other older but popular blockchains also rallied, with ADA passing $1.00, DOT hitting $40 and RVN rising from $0.075 to a high of $0.29 in just 1 week.

With BNB having taken the number 3 spot after rallying 300% over the week, DOT is hot on its heels trying to catch it at number 4. As more tokens start to rally significantly, the Crypto Top 10 is starting to reshuffle, making it a very interesting table to watch.

While the altcoins battle for the lower places, BTC remains firmly seated at number 1 with its market capitalisation having crossed $1 trillion after it bounced up late week to a new ATH of $58,300 after consolidating a few days since breaking $50,000 on Tuesday.

Blackrock, Motley Fool, Declares BTC Investment

Institutional interest in BTC is getting more heated, with Blackrock revealing mid-week that they too have started to invest in BTC. The news sent the price of BTC soaring above $50,000 for the first time, proving Gold bug Peter Schiff wrong, as he said that BTC will never pass $50,000. He nonetheless admitted his mistake but remained sceptical of the asset.

Not only did BTC pass $50,000, it continued to advance to $58,300 on the back of news that even Motley Fool, the very popular investment advisory platform which barely 6 months ago, was advising its clients against buying BTC, announced that it is going to spend $5 million from its own fund to buy BTC in the coming weeks, with the expectation that it will rise to $500,000.

The firm will be investing in BTC through its 10X real-money portfolio as one of 40 assets that it predicts will provide a 1,000% return over the next 15 years. The firm has started recommending BTC as a core holding to all its 10X members.

According to data, Motley Fool is currently ranked fifth globally in the investing category, and has 87 million website visits per month. Hence, its endorsement can potentially bring a new wave of investors into BTC, which will be very good for its price.

The BTC buying frenzy has spread to Germany, with Cannabis firm Synbiotic SE, listed on the Frankfurt Stock Exchange, revealing that it has bought BTC to hedge against currency devaluation as well.

On-chain data seems to prove that large buyers are the ones accumulating the bulk of BTC, with addresses holding more than 10 million BTC skyrocketing ever since BTC crossed $20,000.

Meanwhile, MicroStrategy, who already has more than 71,000 units of BTC, just cannot get enough of it. It announced yet another bond sale to purchase BTC, and managed to raise $1.05 billion, $400 million more than it expected. MicroStrategy will very likely be putting this newfound $1 billion to purchase more BTC this coming week.

Market-watchers think that MicroStrategy already spent its $1 billion to buy BTC as around $1 billion worth of BTC was observed to have been withdrawn from Coinbase on Sunday.

The other big whale, Grayscale Trusts, added another 1,640 BTC, 27,480 ETH, 4,058 LTC and made one of its biggest purchases of BCH, buying 15,263 units, over the course of last week.

The adoption craze has also spread to Dubai, with a Dubai government-owned company announcing that it will accept cryptocurrency as payment, singling out BTC, ETH and USDT. Further to that, a Dubai-based public relations company, Falcon Corporate Services FZC, has invested 75% of its corporate treasury, worth a couple of millions, in BTC.

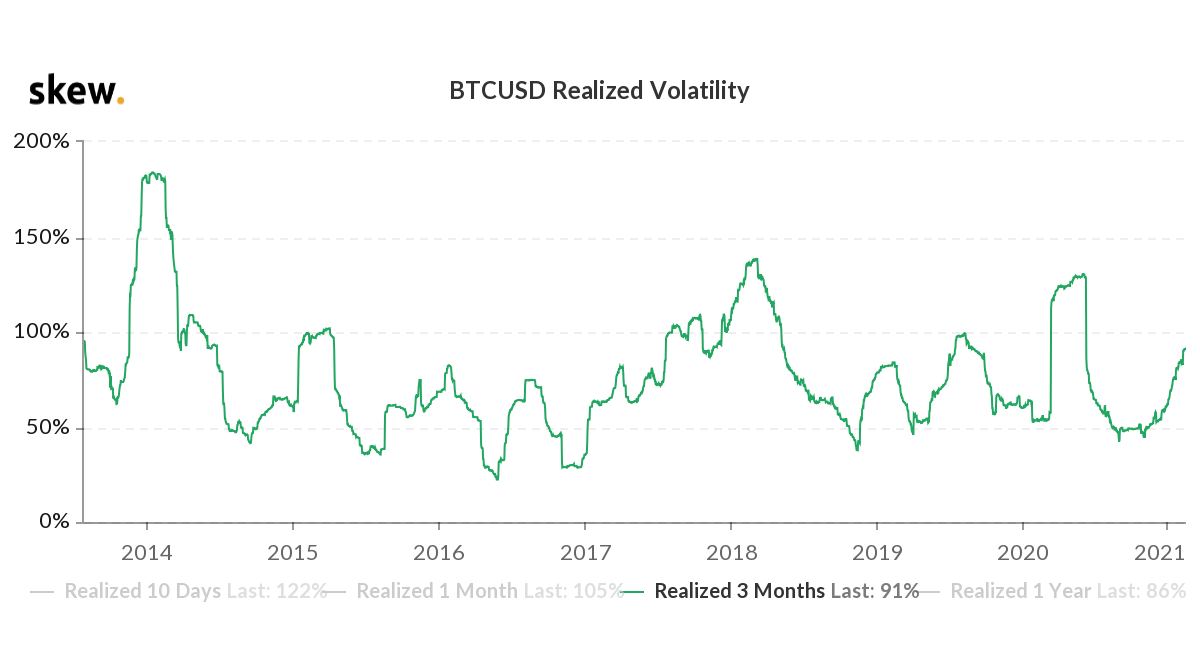

Despite having risen quite a bit since December, the 3-month price volatility of BTC is still lower than that of 2017, a reflection of the profile of BTC investors now against that in 2017 when investors were more panicky and fickler. Investors of BTC today are more long-term players with less intention to sell as the price goes up, and less pressure to cut loss even as price drops, reducing volatility.

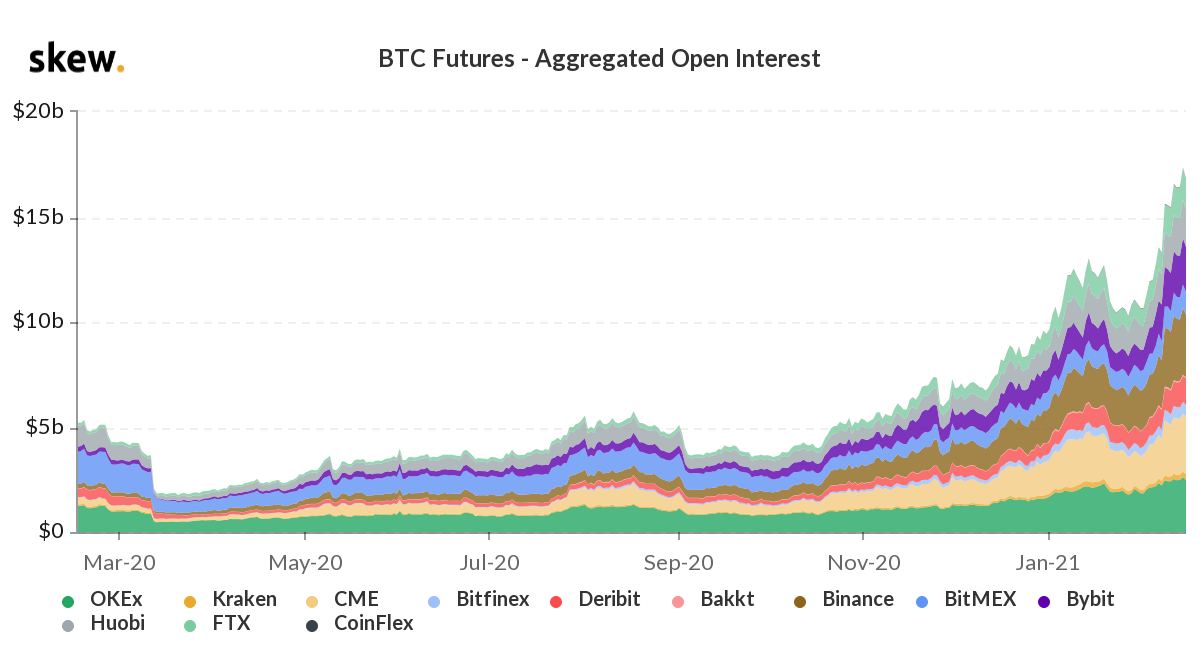

This could also be a sign that BTC is slowly maturing into a mainstream investment asset as more mainstream products on it are introduced, bringing in more traditional asset class players. For instance, the Futures Open Interest has skyrocketed back after declining briefly at the end of January, posting an ATH of $17 billion.

Meanwhile, North America’s first BTC ETF debuted on the Toronto Stock Exchange on Thursday with a strong start, with around $165 million worth of shares changing hands on its first day on strong demand. With such strong demand in BTC ETF, it may be sooner rather than later that the SEC approves a BTC ETF in the USA.

ETH Breaks $2,000 Finally Albeit Briefly

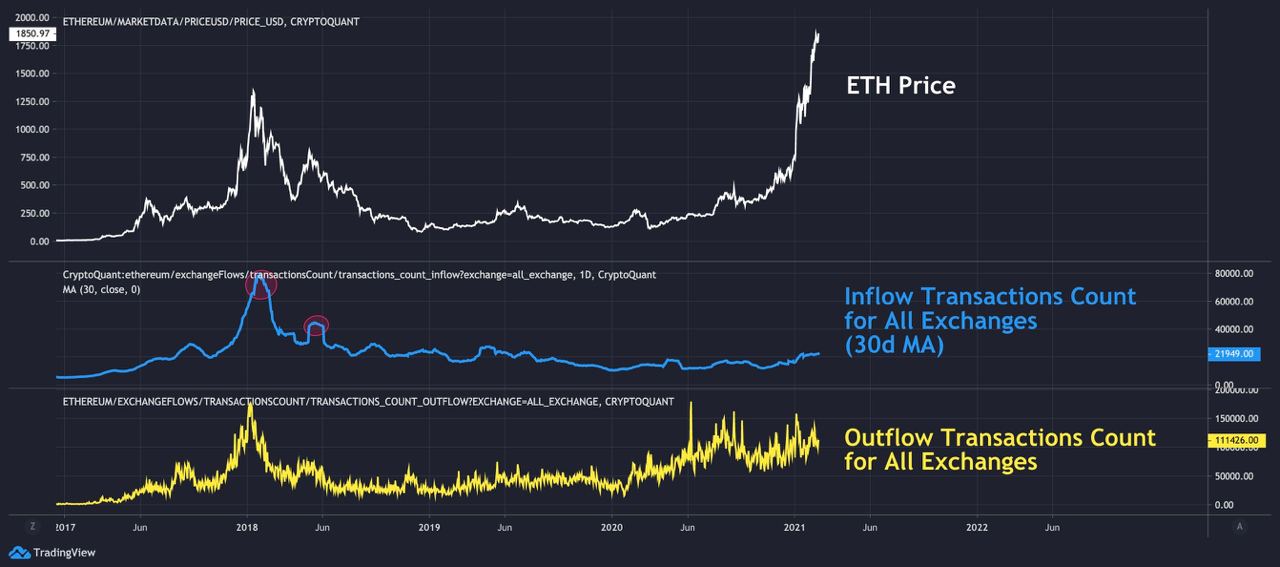

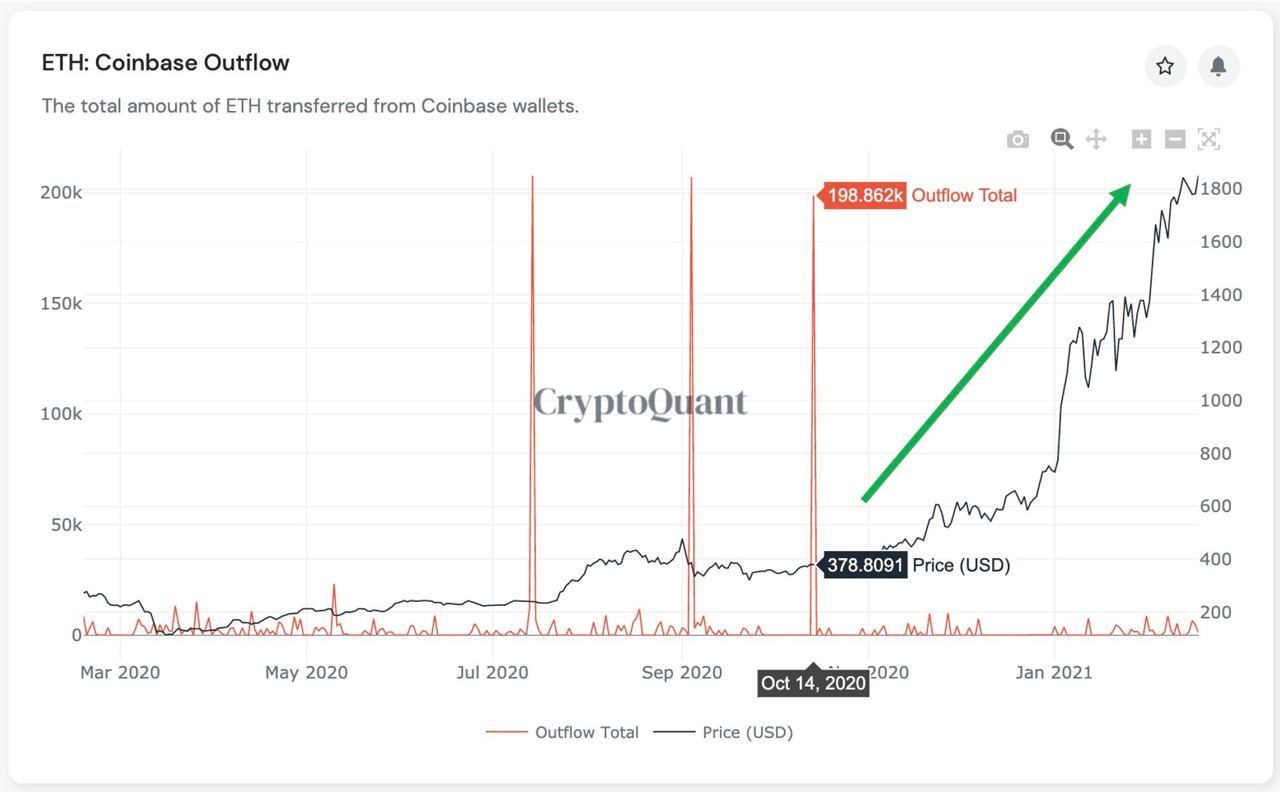

Of course, not to be outrun by BTC and other altcoins, ETH also posted strong gains, surpassing the psychological $2,000 mark for the first time briefly before retracing to below $1,900. The up move has been widely anticipated, as on-chain metrics have remained very strong for ETH for a long time despite it lagging the market this time around.

Exchange deposits of ETH have been slowly declining while outflows have continued to remain elevated.

In particular, Coinbase exchange has seen significant outflow of ETH since mid-October last year.

XRP Rallies 20% Ahead of First Day of Hearing

On XRP, even though there was news of the SEC and Ripple not planning to settle the lawsuit out of court, and further to that, that the SEC amended charges to specifically charge Ripple’s 2 founders on top of the existing suit against Ripple, the XRP token nonetheless went up to $0.56 as a result of the broad market rallying.

The court hearing is scheduled to start on 22 February which is today. Any news out may have an impact on the price of XRP, traders in XRP do take note of this event and of the upcoming hearing dates. However, according to experts, the lawsuit is not expected to have an outcome until August this year, which is still 6 months away.

This may limit the upside of XRP to around 0.755 previously made on 1st February even though the token may rise and fall with any news flow out of the lawsuit. As for today, it has managed to post a 20% rally when the broad market is doing a retracement after Elon Musk made a comment on Sunday that BTC and ETH prices are a bit high. Will this open the door to more corrections ahead or be the consolidation that the market needs to go higher this week.

About Kim Chua, Noble Pro Trades Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.